All Categories

Featured

Table of Contents

- – How do I apply for Real Estate For Accredited ...

- – How do I apply for Residential Real Estate For...

- – What is Real Estate Development Opportunities...

- – What is the difference between Real Estate Cr...

- – Who provides reliable Accredited Investor Re...

- – How do I apply for Residential Real Estate F...

Rehabbing a house is taken into consideration an active investment strategy. On the various other hand, easy actual estate investing is terrific for investors who desire to take a less involved method.

With these methods, you can take pleasure in passive income with time while permitting your financial investments to be taken care of by a person else (such as a residential or commercial property monitoring company). The only point to keep in mind is that you can lose on several of your returns by working with somebody else to handle the investment.

One more consideration to make when selecting a real estate spending approach is direct vs. indirect. Comparable to energetic vs. easy investing, straight vs. indirect refers to the degree of involvement called for. Direct financial investments involve actually purchasing or handling properties, while indirect methods are much less hands on. For instance, REIT investing or crowdfunded residential properties are indirect property investments.

Register to participate in a FREE on-line realty course and learn just how to begin buying genuine estate.] Many investors can obtain so captured up in determining a residential property kind that they do not recognize where to begin when it pertains to discovering a real property. As you acquaint on your own with different building types, additionally be sure to learn where and just how to discover each one.

How do I apply for Real Estate For Accredited Investors?

There are lots of residential or commercial properties on the marketplace that fly under the radar because capitalists and buyers do not know where to look. Several of these homes struggle with inadequate or non-existent advertising, while others are overpriced when detailed and therefore failed to receive any type of interest. This suggests that those capitalists ready to sort via the MLS can discover a variety of financial investment possibilities.

By doing this, financiers can continually track or look out to brand-new listings in their target location. For those questioning exactly how to make connections with real estate agents in their corresponding locations, it is an excellent idea to go to local networking or actual estate event. Capitalists searching for FSBOs will additionally find it advantageous to deal with a genuine estate agent.

How do I apply for Residential Real Estate For Accredited Investors?

Capitalists can likewise drive with their target areas, seeking indicators to find these buildings. Keep in mind, identifying buildings can take some time, and investors should prepare to utilize numerous angles to protect their following deal. For financiers residing in oversaturated markets, off-market residential properties can stand for a chance to be successful of the competition.

When it comes to looking for off-market residential or commercial properties, there are a couple of sources investors should check. These consist of public records, realty auctions, wholesalers, networking occasions, and contractors. Each of these sources represents a distinct possibility to locate buildings in a given location. As an example, dealers are typically conscious of fresh rehabbed residential or commercial properties readily available at reasonable costs.

What is Real Estate Development Opportunities For Accredited Investors?

There are repossessions. Regardless of many proclamations in the news that foreclosures are disappearing, information from RealtyTrac remains to show spikes in activity around the country. Years of backlogged repossessions and boosted inspiration for financial institutions to retrieve could leave also a lot more repossessions up for grabs in the coming months. Investors looking for repossessions need to pay cautious attention to newspaper listings and public records to find possible buildings.

You should think about investing in real estate after discovering the various advantages this asset has to supply. Usually, the constant demand supplies real estate lower volatility when contrasted to other financial investment kinds.

What is the difference between Real Estate Crowdfunding For Accredited Investors and other investments?

The reason for this is since genuine estate has reduced connection to other investment types therefore offering some defenses to financiers with various other asset types. Different kinds of realty investing are connected with various levels of risk, so make certain to discover the ideal investment strategy for your objectives.

The procedure of getting residential property entails making a down settlement and financing the rest of the sale price. Therefore, you only pay for a tiny percentage of the property in advance however you manage the entire investment. This type of leverage is not offered with other investment kinds, and can be made use of to further expand your financial investment portfolio.

Due to the wide selection of alternatives available, lots of investors likely discover themselves questioning what actually is the ideal actual estate investment. While this is an easy question, it does not have a basic response. The most effective type of investment building will rely on several factors, and investors ought to be careful not to eliminate any choices when searching for prospective bargains.

This article discovers the possibilities for non-accredited investors looking to venture into the profitable realm of property (Real Estate Investment Partnerships for Accredited Investors). We will certainly explore numerous financial investment avenues, regulatory considerations, and methods that equip non-accredited people to harness the potential of realty in their financial investment profiles. We will certainly likewise highlight how non-accredited investors can function to become accredited capitalists

Who provides reliable Accredited Investor Real Estate Partnerships options?

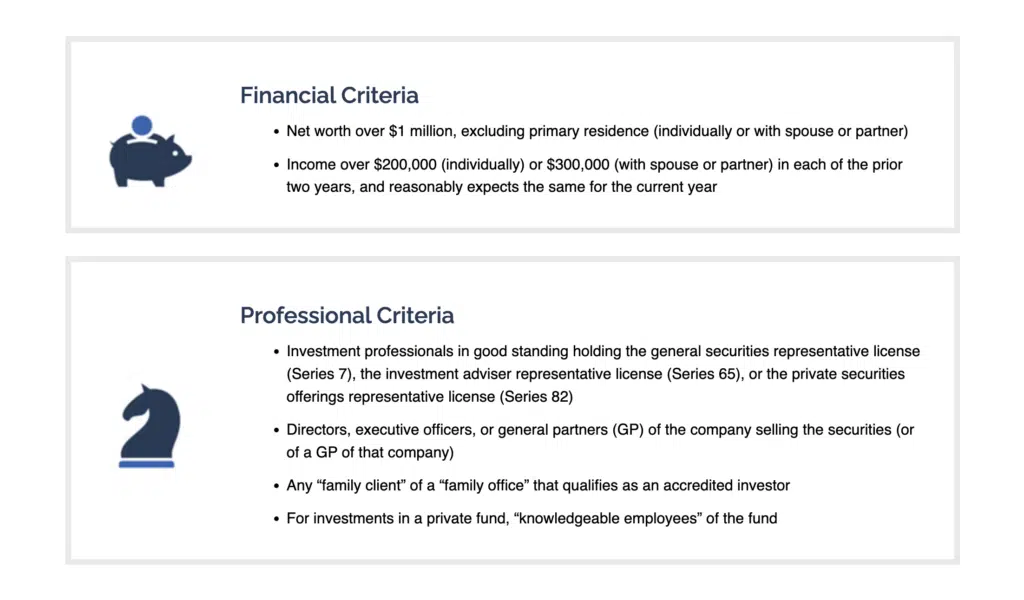

These are usually high-net-worth individuals or firms that meet accreditation needs to trade personal, riskier financial investments. Earnings Criteria: People must have a yearly income going beyond $200,000 for two successive years, or $300,000 when combined with a spouse. Web Worth Demand: A total assets going beyond $1 million, leaving out the key residence's worth.

Investment Knowledge: A clear understanding and recognition of the threats connected with the financial investments they are accessing. Paperwork: Ability to give monetary statements or various other documentation to verify earnings and web worth when asked for. Property Syndications need certified investors due to the fact that sponsors can just allow recognized capitalists to subscribe to their investment possibilities.

How do I apply for Residential Real Estate For Accredited Investors?

The first typical misunderstanding is once you're an accredited investor, you can keep that condition indefinitely. To come to be a certified financier, one need to either strike the earnings standards or have the web well worth need.

REITs are attractive because they yield stronger payments than typical stocks on the S&P 500. High return returns Profile diversification High liquidity Dividends are exhausted as average revenue Sensitivity to passion prices Dangers connected with particular residential properties Crowdfunding is an approach of on-line fundraising that involves asking for the public to add cash or startup resources for brand-new tasks.

This enables entrepreneurs to pitch their concepts directly to everyday web customers. Crowdfunding provides the ability for non-accredited investors to become shareholders in a company or in a property building they would not have actually been able to have accessibility to without accreditation. Another benefit of crowdfunding is portfolio diversification.

The 3rd advantage is that there is a lower barrier to entrance. In some instances, the minimum is $1,000 dollars to purchase a company. In a lot of cases, the financial investment seeker needs to have a record and remains in the infancy phase of their task. This could indicate a greater threat of shedding a financial investment.

Table of Contents

- – How do I apply for Real Estate For Accredited ...

- – How do I apply for Residential Real Estate For...

- – What is Real Estate Development Opportunities...

- – What is the difference between Real Estate Cr...

- – Who provides reliable Accredited Investor Re...

- – How do I apply for Residential Real Estate F...

Latest Posts

Back Tax Properties For Sale

Tax Lien Sale List

Tax Foreclosure Property Listings

More

Latest Posts

Back Tax Properties For Sale

Tax Lien Sale List

Tax Foreclosure Property Listings