All Categories

Featured

Table of Contents

Rehabbing a residence is taken into consideration an energetic financial investment method. On the other hand, easy genuine estate investing is fantastic for financiers who desire to take a much less involved approach.

With these approaches, you can delight in passive income in time while permitting your financial investments to be taken care of by somebody else (such as a home management firm). The only thing to remember is that you can lose on several of your returns by hiring somebody else to take care of the investment.

An additional factor to consider to make when picking a realty investing strategy is straight vs. indirect. Similar to energetic vs. easy investing, straight vs. indirect refers to the degree of involvement needed. Direct financial investments entail actually buying or managing residential or commercial properties, while indirect techniques are less hands on. For instance, REIT spending or crowdfunded residential or commercial properties are indirect realty financial investments.

Register to participate in a FREE on the internet realty course and learn just how to start buying genuine estate.] Several investors can obtain so caught up in recognizing a home type that they don't understand where to start when it pertains to discovering an actual building. So as you familiarize on your own with various home kinds, also make certain to discover where and exactly how to discover each one.

Are there budget-friendly Accredited Investor Real Estate Syndication options?

There are bunches of residential or commercial properties on the market that fly under the radar since capitalists and homebuyers do not recognize where to look. Several of these residential properties experience inadequate or non-existent advertising, while others are overpriced when provided and as a result failed to receive any attention. This indicates that those capitalists going to arrange through the MLS can find a selection of financial investment possibilities.

In this manner, capitalists can continually track or look out to brand-new listings in their target location. For those wondering just how to make links with realty representatives in their corresponding locations, it is an excellent idea to go to neighborhood networking or real estate event. Investors searching for FSBOs will likewise discover it advantageous to work with a property representative.

Real Estate Investment Funds For Accredited Investors

Investors can likewise drive with their target locations, searching for indicators to locate these properties. Keep in mind, identifying buildings can require time, and investors should be ready to use multiple angles to secure their following deal. For capitalists staying in oversaturated markets, off-market residential or commercial properties can represent an opportunity to be successful of the competition.

When it comes to looking for off-market residential or commercial properties, there are a few sources investors need to check. These consist of public documents, real estate auctions, wholesalers, networking events, and specialists.

Can I apply for Real Estate Investment Funds For Accredited Investors as an accredited investor?

Years of backlogged repossessions and enhanced inspiration for banks to reclaim might leave even more foreclosures up for grabs in the coming months. Investors browsing for repossessions should pay mindful interest to newspaper listings and public documents to find prospective residential or commercial properties.

You need to take into consideration buying realty after learning the numerous advantages this property has to use. Historically, property has actually carried out well as an asset course. It has a favorable partnership with gross domestic product (GDP), meaning as the economic climate grows so does the need for real estate. Usually, the constant need offers property lower volatility when contrasted to various other financial investment kinds.

Who offers flexible Accredited Investor Commercial Real Estate Deals options?

The factor for this is because genuine estate has low relationship to other financial investment types therefore using some securities to financiers with various other asset types. Various types of actual estate investing are related to various degrees of risk, so be sure to discover the appropriate financial investment method for your objectives.

The procedure of buying building includes making a down repayment and financing the remainder of the list price. Therefore, you only spend for a little percentage of the residential property up front yet you manage the entire financial investment. This form of leverage is not readily available with various other investment types, and can be used to more expand your investment portfolio.

Due to the wide variety of choices readily available, lots of capitalists likely locate themselves wondering what truly is the ideal genuine estate financial investment. While this is an easy question, it does not have a basic solution. The best sort of investment residential property will certainly depend on lots of factors, and investors ought to beware not to eliminate any options when looking for potential bargains.

This short article discovers the possibilities for non-accredited financiers looking to endeavor into the lucrative world of realty (Real Estate Crowdfunding for Accredited Investors). We will look into various investment opportunities, regulatory factors to consider, and strategies that encourage non-accredited individuals to harness the possibility of realty in their investment profiles. We will certainly likewise highlight exactly how non-accredited capitalists can function to come to be accredited financiers

Residential Real Estate For Accredited Investors

These are generally high-net-worth individuals or business that fulfill certification demands to trade private, riskier financial investments. Revenue Criteria: People need to have a yearly earnings exceeding $200,000 for 2 successive years, or $300,000 when integrated with a spouse. Internet Worth Need: A total assets exceeding $1 million, excluding the key house's worth.

Financial investment Understanding: A clear understanding and awareness of the risks linked with the investments they are accessing. Documentation: Ability to offer economic declarations or other documents to validate income and web worth when asked for. Realty Syndications need recognized investors since enrollers can just permit recognized investors to subscribe to their financial investment chances.

Accredited Investor Real Estate Deals

The very first common misunderstanding is once you're a recognized capitalist, you can maintain that standing indefinitely. Accreditation lasts for five years and have to be resubmitted for authorization upon that due date. The 2nd false impression is that you have to strike both financial benchmarks. To come to be a recognized financier, one must either hit the income criteria or have the internet worth demand.

REITs are appealing since they generate more powerful payments than standard supplies on the S&P 500. High return returns Portfolio diversification High liquidity Rewards are tired as regular revenue Level of sensitivity to rates of interest Dangers connected with certain homes Crowdfunding is an approach of on the internet fundraising that entails asking for the public to contribute money or start-up resources for new projects.

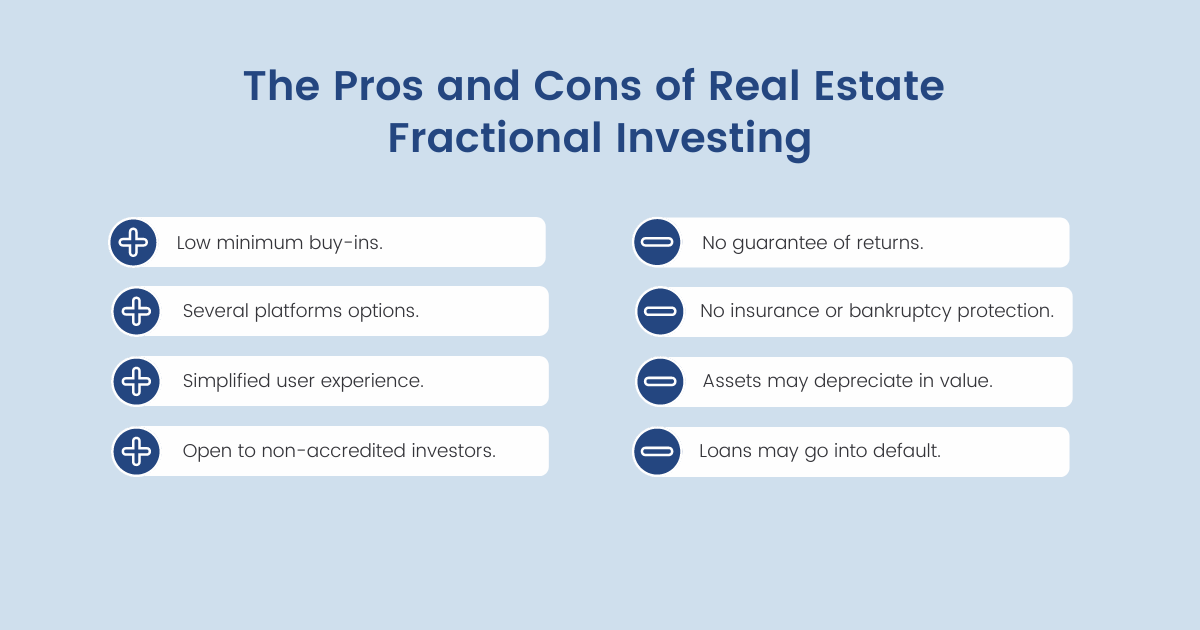

This allows business owners to pitch their concepts straight to day-to-day net users. Crowdfunding supplies the capacity for non-accredited capitalists to become investors in a company or in a real estate building they would certainly not have been able to have accessibility to without certification. An additional advantage of crowdfunding is profile diversity.

In numerous instances, the investment candidate needs to have a track document and is in the infancy stage of their job. This can mean a higher threat of shedding a financial investment.

Table of Contents

Latest Posts

Back Tax Properties For Sale

Tax Lien Sale List

Tax Foreclosure Property Listings

More

Latest Posts

Back Tax Properties For Sale

Tax Lien Sale List

Tax Foreclosure Property Listings